Investors Are Ignoring Some Important Risks – January 14, 2019

Investors Are Ignoring Some Important Risks

Global financial markets have rioted in recent months, as a recession is now seen as a near-certainty by many investors. The dramatic souring in sentiment towards risk assets has occurred against a backdrop of only a modest deterioration in economic momentum. Global geopolitical tensions, especially those related to trade, have escalated. However, the market meltdown in late-2018 was overdone.

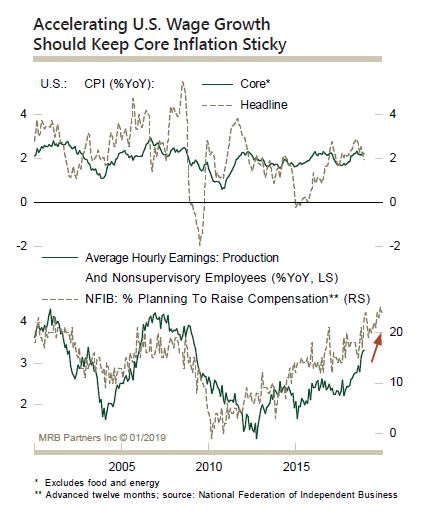

Importantly, the key driver of global demand growth, the U.S. economy, continues to chug along. Moreover, our negative stance on fixed income remains intact, because as the report concluded: “core inflation has lagged wage growth recently, but will catch up over the coming months”.

The wild ride in the financial markets should calm in the near run, but the cycle is not yet over – stay tuned.