Fed Chair Powell: Party On – August 26, 2024

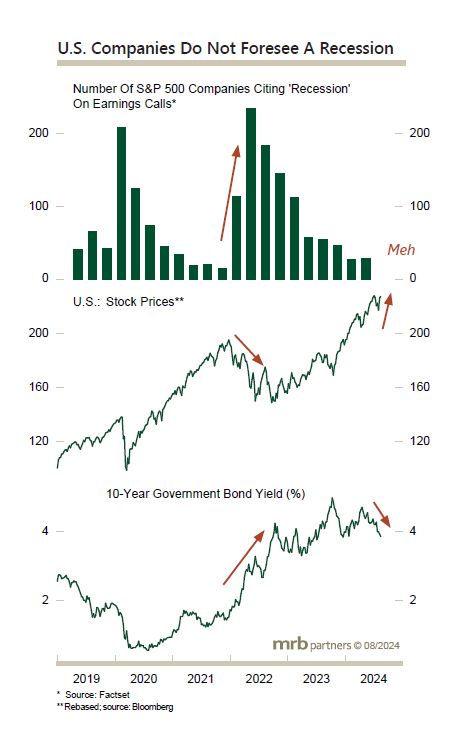

Fed Chair Powell forcefully stated that U.S. rate cuts are now coming in his Jackon Hole speech on Friday, only the magnitude and specific timing is uncertain. A just-published report reiterated our pro-growth investment stance, highlighting that the risk-on phase will persist until bond yields reverse course, which is not imminent with the Fed set to cut rates.

Much ink has been spilt claiming that the U.S. labor market has weakened considerably. We came to a much more upbeat conclusion in a report last week, which examined the U.S. economic outlook in detail (MRB U.S. Economy: “Key Indicators”). Nevertheless, Powell has returned to his pre-2022 goal of letting the labor market run as hot as it can. Net: his dovish rhetoric and looming rate cuts will help to sustain both economic activity and asset inflation.

This “party” phase will last until investors realize that the economy is still growing above its long-run potential and domestic service sector inflation is holding up well above the Fed’s 2% inflation target. At that point, the next upleg in bond yields will gradually take hold. Until then, party on.