Unwinding Distortions – November 4, 2024

The U.S. economy has solid momentum heading into this week’s election. Whether the next President and Congress decide to pursue more aggressive protectionist policies and risk a stagflation outcome is difficult to handicap. However, investors will need to closely monitor actual political actions and avoid getting too wrapped up in rhetoric and negotiation tactics.

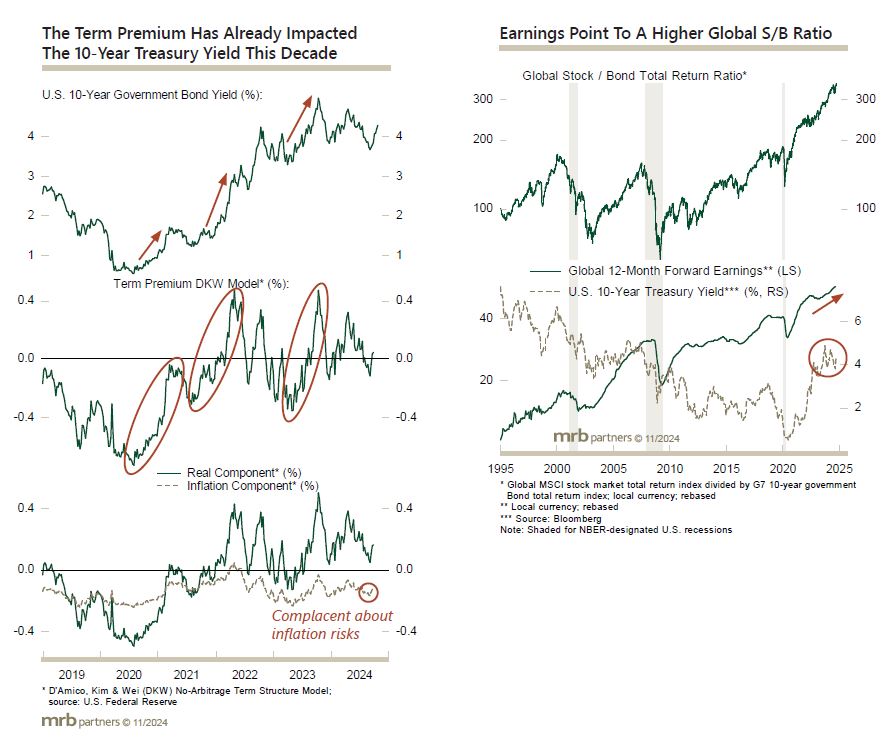

If politicians do not derail the economic expansion, then a number of distortions that have persisted this decade should gradually unwind, mostly to the detriment of bond investors. A just-published report examined a number of these distortions, especially the issue of the Treasury market term premium (which is not directly observable), that has been depressed since the secular stagnation narrative was adopted by the Fed last decade. There have been three recent periods when the term premium rose, pushing up Treasury yields, and continued above-potential economic growth at a time of a positive output gap warns that further upward pressure looms. Our absolute return MRB TradeBook has a short recommendation on 10-year U.S. Treasurys and an overall moderate pro-growth stance, but is keeping tight stops.