U.S. Housing Market: A Bumpy, But Still Bullish Outlook – May 24, 2021

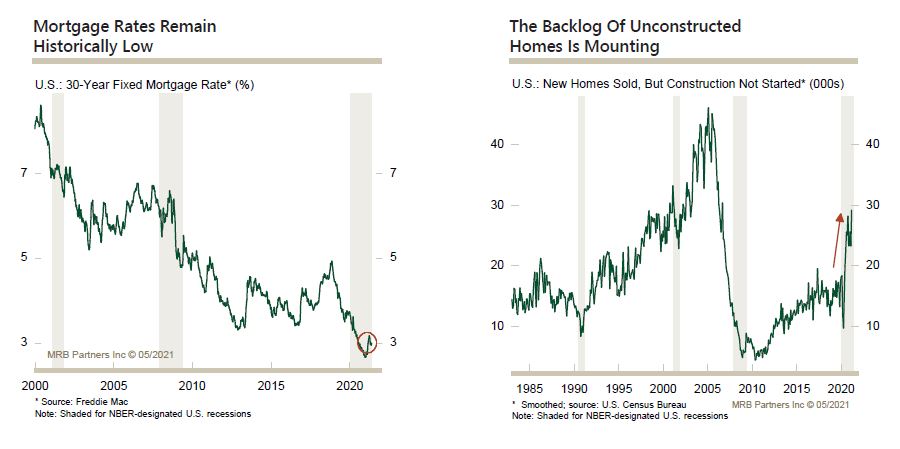

A just-published report updated our views on the U.S. housing market, which has undergone an unusual recession/recovery profile in the past year. Housing demand stayed remarkably solid through the recession, held up by buyers in mid-to-high price tiers of the market. The expected improvement in the labor market, strong fiscal support and historically still-low mortgage rates portend a solid impetus to housing demand ahead from younger, entry-level buyers.

Still, the path forward could be bumpy. The sharp rise in home prices and constraints to new construction, including the cost and availability of lumber and labor, could slow entry-level purchases over the next few months. However, unlike a prolonged, self-reinforcing demand-led downturn, a supply-driven slowdown is likely to last only until the constraints on construction ease, likely by the autumn.

In sum, the outlook for U.S. housing remains positive on a multi-year basis, given a strong demographic impetus for homeownership, solid household balance sheets and a low existing stock of housing. This, in turn, bodes positively for the consumer sector and overall GDP growth.