The Outlook Is Still Positive, But More Challenging – May 6, 2019

The Outlook Is Still Positive, But More Challenging

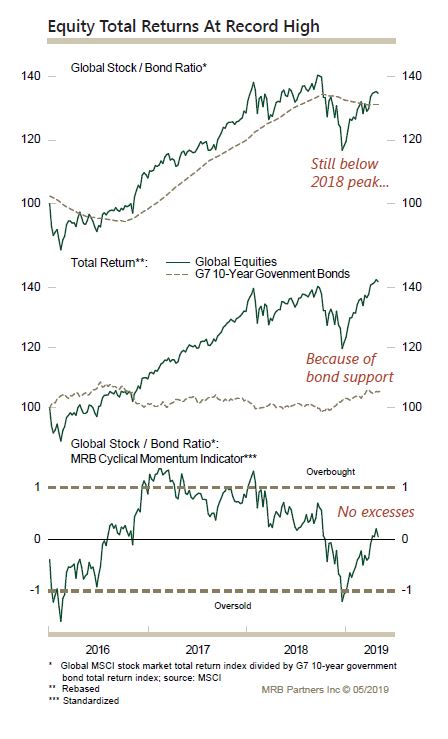

Global financial markets have enjoyed huge returns this year, albeit this followed a brutal risk-off phase in 2018. Looking ahead, there are some factors that likely will mute returns in the near run, such as the lingering softness in corporate profits, weak global trade, short-term overbought conditions in equity markets, and a flatter profile in bond yields after the relentless slide in the past six months or so.

However, the 6-12 month view is still modestly positive for most risk assets, given the prospects for better global economic growth, dovish central banks, low interest rates and bond yields, and few excesses in equity markets. Thus, we are maintaining a moderately pro-growth investment stance, expecting the global stock/bond ratio to grind higher.