Overdue For Some Good News? – October 24, 2022

A just-published report examined global financial market prospects after what has been a relentless stretch of bad news. How might the environment evolve if things turn more favorable, or at least less bad?

Global equities and G7 bonds are now deeply oversold, while the U.S. dollar is extremely overbought. Some possible catalysts for at least a temporary change in the macro and investment landscape include:

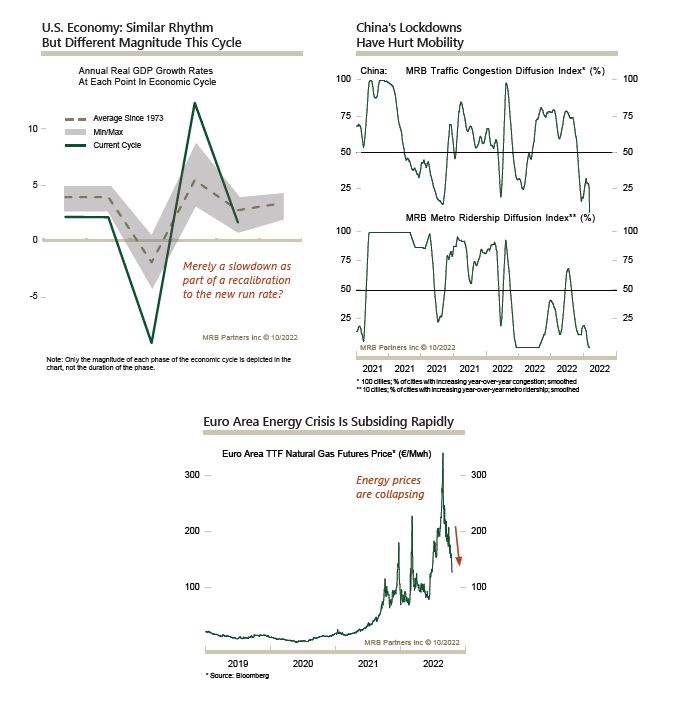

- The U.S. and global slowdown proves to be mostly a recalibration to a new sustained rate of expansion, rather than a slide into recession;

- The euro area energy crisis soon ends;

- China’s COVID-zero policy relaxes on the margin, and becomes progressively less economically-disruptive.

All outcomes are possible. A risk-on phase requires a window where the upward adjustment in interest rates expectations and bond yields pauses, while global growth prospects improve a notch. Such a reprieve will ultimately prove self-limiting because bond yields will eventually resume rising.

We continue to recommend that clients be cyclically cautious when setting investment strategy, yet willing to take tactical risks from time-to-time.