Beware Of Bearish Yield Curve Interpretations – April 1, 2019

Beware Of Bearish Yield Curve Interpretations

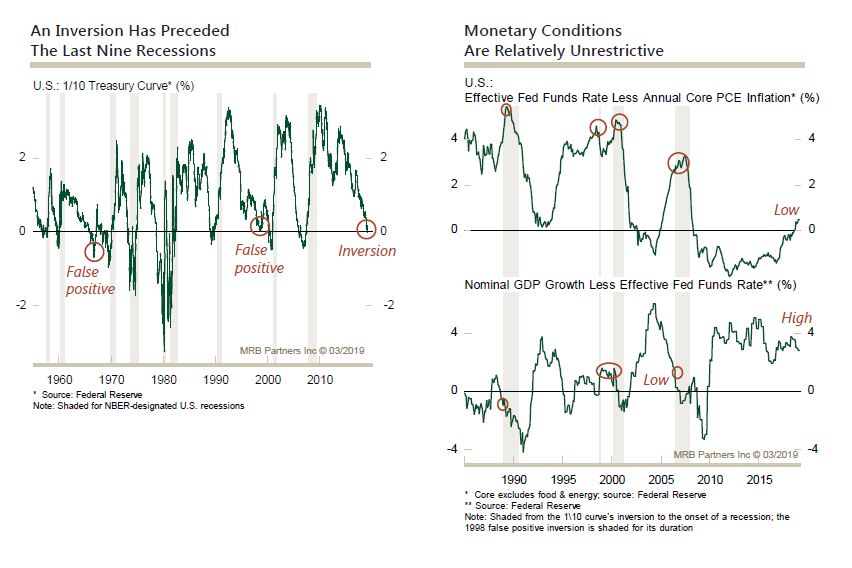

The shift towards yield curve inversion in the U.S. and abroad is widely seen as confirmation that a recession is approaching. We disagree.

Examining the history of U.S. yield curve inversions highlights a number of critical factors that do not point in a bearish economic direction, including the difference between a bull inversion (the current backdrop) and bear inversions (the backdrop that heralded recessions).

– Restrictive Fed policy has led previous yield curve inversions; monetary policy is not currently restrictive.

– Unusually and ironically, the recent dovish policy shift (the end of quantitative tightening) was likely a contributing factor driving the recent inversion.

– The current inversion will likely reinforce the Fed’s dovish bias; by contrast, past inversions did not prevent additional Fed policy tightening.

– We expect growth to remain modestly above-potential this year.