A just-published report updated our absolute return portfolio, which remains positioned for a pro-growth backdrop. However, we acknowledge that the environment is becoming increasingly frothy and risk asset market valuations are stretched. Nevertheless, already plentiful liquidity conditions are set to receive another shot of stimulus with the Fed set to resume lowering its policy rate.

The major developed market central banks continue to grossly underestimate the level of equilibrium policy rates and have maintained accommodative monetary settings. Their claims that policy has been “restrictive” is inconsistent with economic, inflation and asset price trends. Meanwhile, fiscal authorities are increasing debt burdens to achieve better near-term economic growth objectives at the expense of future generations. Indeed, most DM governments are running recession-level deficits during economic expansions.

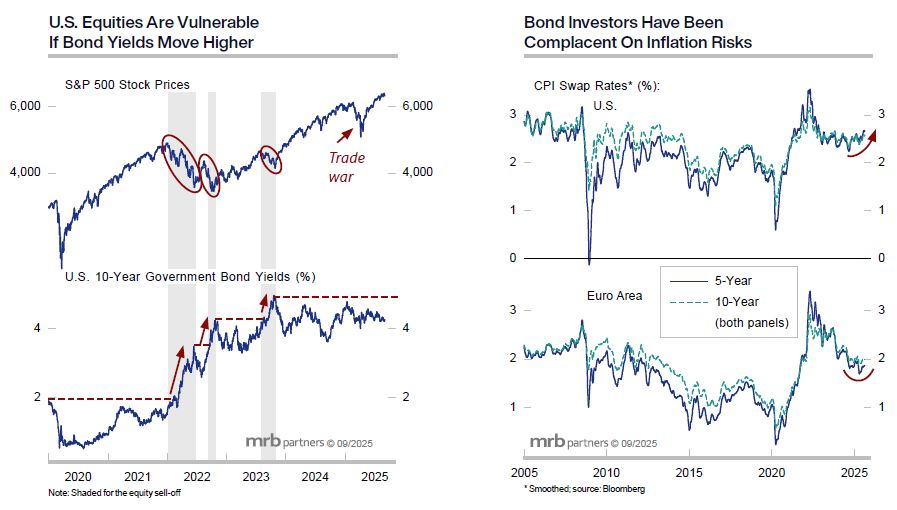

Net: the world economy and global financial markets are receiving too much stimulus, which is a policy mistake but one that should support pro-growth asset markets. Still, selectivity and/or adding some portfolio insurance is warranted given that risk assets have already enjoyed an extended bull market and exhibit both frothy pricing and lofty earnings expectations. At some point, bond market complacency will end and a shift to defensive positioning will be warranted. Our advice remains: maintain stops to protect gains.