A just-published report examined the key drivers of economic and capital markets’ performance. The challenge for investors is that these variables are difficult to forecast. These known unknowns include the rate of productivity growth in the major economies, the related potential GDP growth rate, the size of the output gap and its relationship with inflation, the long-run equilibrium interest rate, the term premium on government bonds, and the equity risk premium.

Long-run productivity growth is the main driver of the real equilibrium interest rate and potential economic growth. Productivity growth will vary across economies but will likely remain historically moderate in the years ahead. Even if stronger productivity growth does occur (say driven by A.I.), then this would still imply that real interest rates would be higher than current levels even if inflation remained tame.

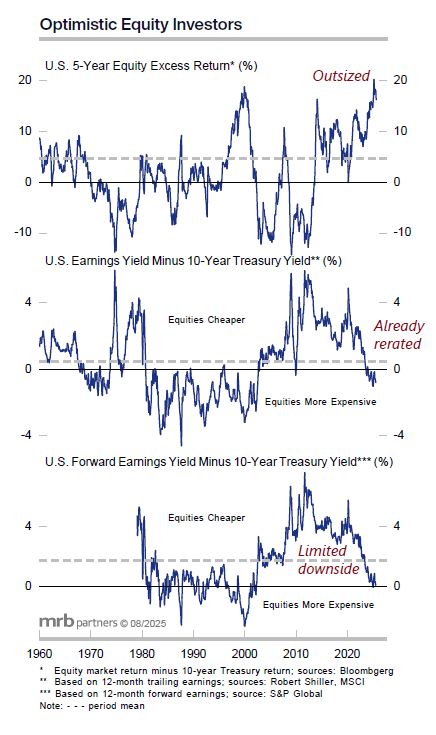

Regardless, real interest rates are currently below equilibrium levels and will rise in the coming decade, in part because the term premium on bonds will rise to reflect the poor G7 fiscal outlook. The starting point for investors today is a particular concern, as global equity risk premia are already low (especially in the U.S.), implying below-average prospective real returns in the medium and longer term.