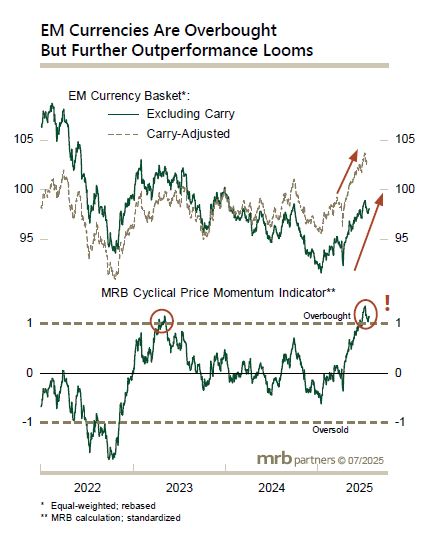

A just-published report updated our views on EM currencies. While the solid rebound in the EM currency basket this year means that these currencies are now overbought, we anticipate more upside ahead and reiterated our overweight stance on the EM within a global FX portfolio.

A combination of cyclical and structural tailwinds will support the relative performance of many EM currencies and bonds over the next several years. U.S. dollar weakness should persist as a pillar of the Trump administration’s attempt to narrow the trade deficit. Meanwhile, non-traditional currency drivers, including currency hedging, private sector repatriation, and portfolio and FDI flows are likely to play a larger and generally positive role for EMFX.

Within an EM currency basket, we recommend a barbell exposure to high-carry currencies and current account surplus currencies with the most long-term upside. Last week we upgraded MXN and KRW from neutral to overweight, and TWD from underweight to overweight, and downgraded the IDR and PHP from overweight to neutral.