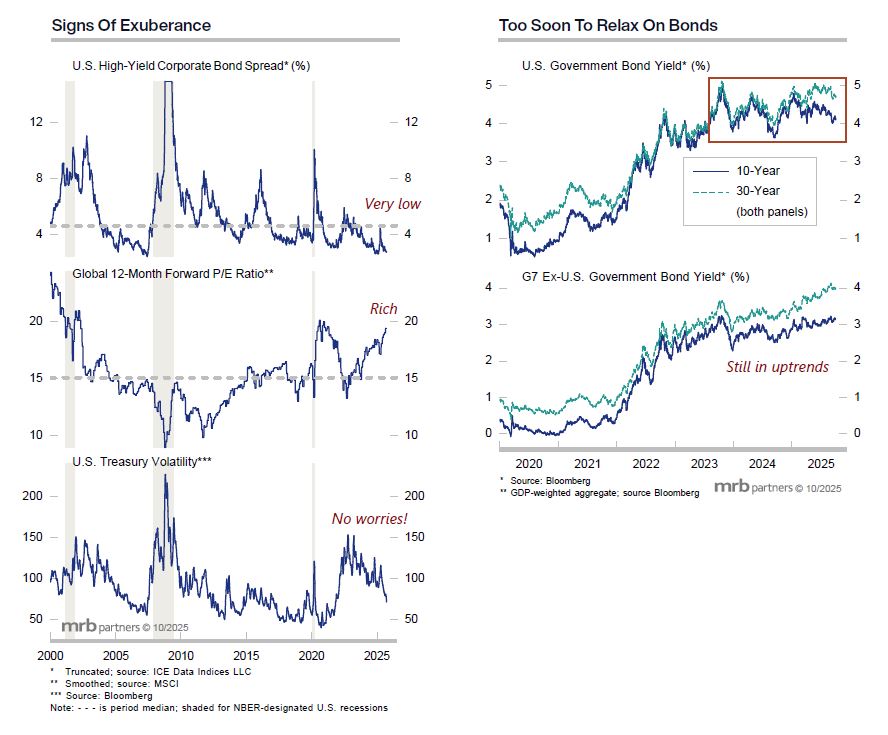

A just-published report updated our global multi-asset portfolio recommendations and re-iterated our mildly pro-growth investment positioning. The macro backdrop of good-to-improving global economic growth and accommodative monetary conditions is supportive of risk asset prices. However, it also must be noted that a lot of good news is already discounted. Signs of froth continue to surface, in a broad range of asset markets.

Still, exuberance can persist for as long as there are no catalysts that will undermine the sources of asset price support. To this end, we anticipate that continued good global growth will eventually translate into another upleg in developed market (DM) government bond yields. The very long end of DM yield curves is signalling some growing tensions on this front, but the U.S. benchmark 10-year Treasury yield has drifted lower of late and remains well below worrisome levels.

Net: keep dancing, but stay close to the exits.