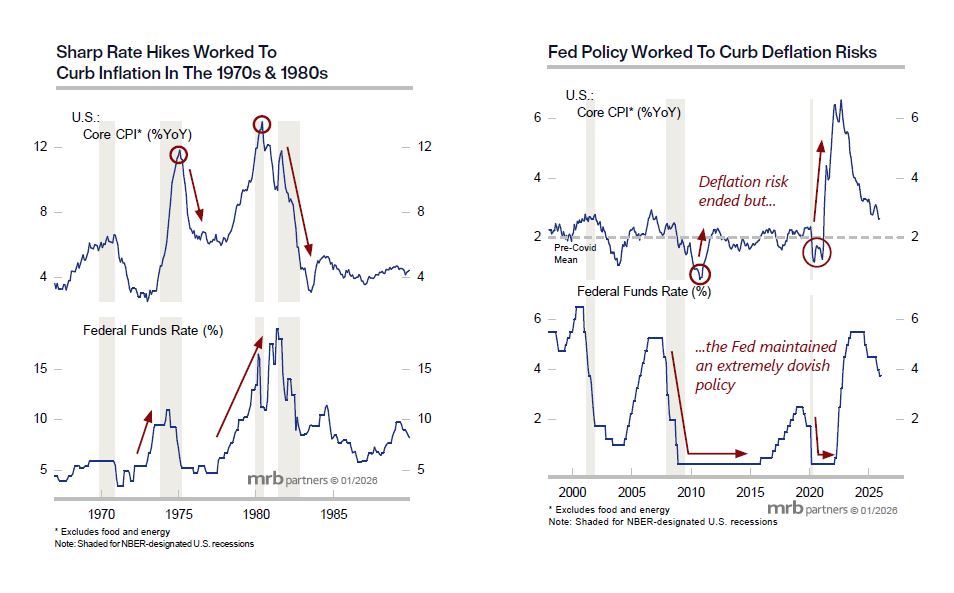

One of MRB’s core fixed-income themes is that the Fed and bond market are mirroring (inversely) the 1980s. Market participants are often reluctant to embrace long-term shifts in underlying macro forces, as they become wedded to their previous mental frameworks. This is especially true at secular turning points in inflation, causing central banks and bond investors to massively lag what is normally a lagging economic variable.

Disinflation in the U.S. was viewed as “transitory” in the 1980s, similar to the current view (in reverse) regarding above-2% inflation. This mindset can persist for many years, causing the cost of capital to lag economic fundamentals and allow the new inflation trend to become entrenched.

We expect U.S. inflation expectations and bond yields to trend higher in the years ahead, as bond zealots will eventually retire (much as occurred with bond vigilantes by the 1990s). Stay structurally short duration.