A just-published report updated our view on the U.S. employment outlook, and concluded that there is no cause for alarm, even though payroll growth has slowed considerably.

There have been repeated bouts of (temporary) angst that the U.S. economy was faltering throughout the post-2009 period. The current candidate for triggering a recession is the sharp slowdown in payroll growth this year. However, recessions do not originate in the labor market, but rather via the interplay of deteriorating corporate profits and weaker final demand. While there are always companies having to cut costs, overall U.S. corporate finances remain healthy.

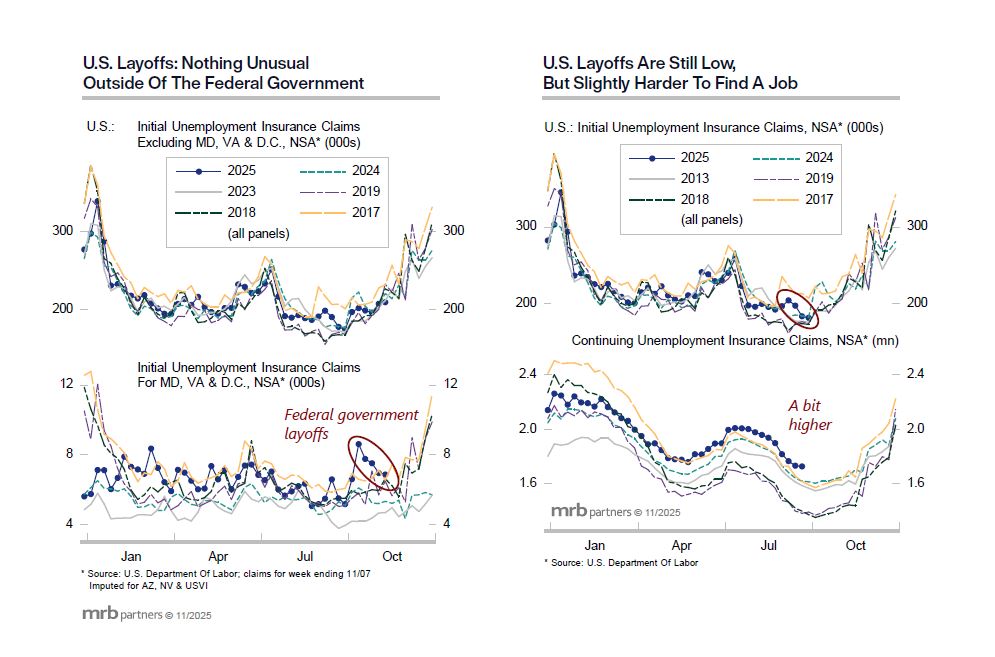

The deceleration in U.S. employment growth this year reflects both demand and supply factors (especially the plunge in net immigration). State data allow one to construct estimates of new unemployment claims, which shows that here has been no change in the benign layoff backdrop of late. It takes a bit longer to find a new job (continuing claims are firmer), but aside from greater government layoffs, the overall backdrop has been stable.

We do not envision a return to strong job growth, but rather modest payroll gains of 30,000 to 50,000/month in 2026. This should be sufficient to keep the economic expansion on track, which will prevent disinflationary pressures from building.