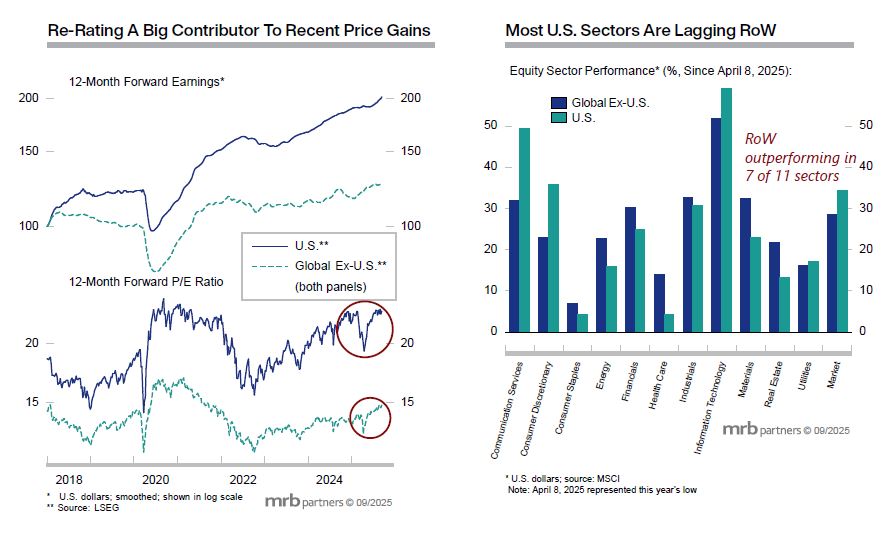

A just-published report concluded that while it is tempting to bet on a continuation of recent equity market momentum, i.e. favoring the U.S. and technology stocks within a global equity portfolio, this strategy has a poor risk-reward profile going forward.

We believe that it is prudent to take advantage of supportive monetary policies to diversify away from the U.S. and its tech dominance, in favor of markets and sectors where expectations and valuations are less elevated. The U.S. market’s performance has been dominated by a handful of expensive stocks with already elevated earnings; in fact, the equal-weighted U.S. index has underperformed its global ex-U.S. counterpart year-to-date and also since the April low, underscoring how dependent U.S. is on a few mega-cap stocks.

Prudent diversification warrants overweight exposure to key non-U.S. markets, namely emerging markets, the euro area and Japan where expectations and valuations are less elevated.