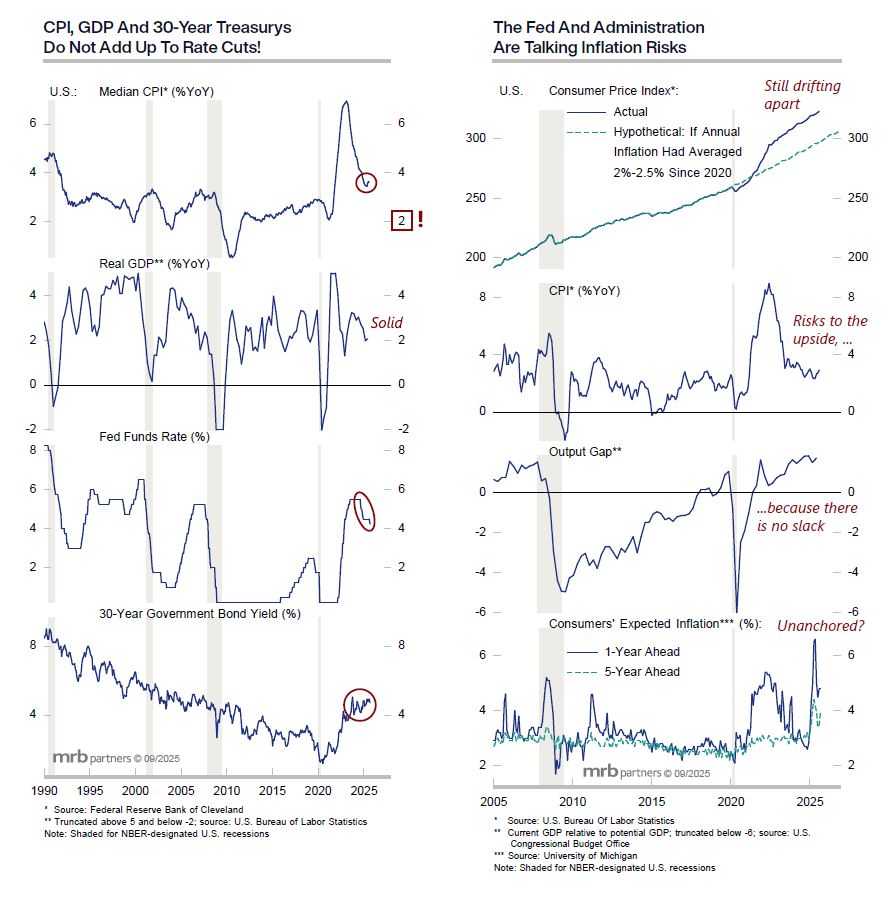

The Fed confirmed on Wednesday that it is now just focussing on maximizing employment, rather than also trying to bring inflation back down to 2%. A just-published report noted that even as the FOMC voted to lower its policy rate, it also upgraded its economic outlook, lowered its forecast for the unemployment rate and even slightly increased its expectation for inflation next year (to a level that is well above 2%).

Such a combination would never be found in a traditional central bank’s economic handbook.

We do not envision the Fed cutting rates beyond this year, and anticipate another sustained rise in bond yields once it is clear that employment conditions have stabilized after this year’s tariff-related slowdown in new hiring (we would note that our research has flagged that the new run-rate for net employment increase will be much lower than in recent years due to the plunge in immigration). U.S. inflation will remain stubbornly above 2%, and is at risk of mildly firming in the coming months. Stay tuned.