A just-published report noted that U.S. corporate profits remained solid in Q2 despite increased tariffs and choppy economic performance during the quarter. The outlook is still fairly positive, albeit expectations are elevated, underscoring that the equity market could hit some bouts of turbulence if earnings suffer even minor disappointments.

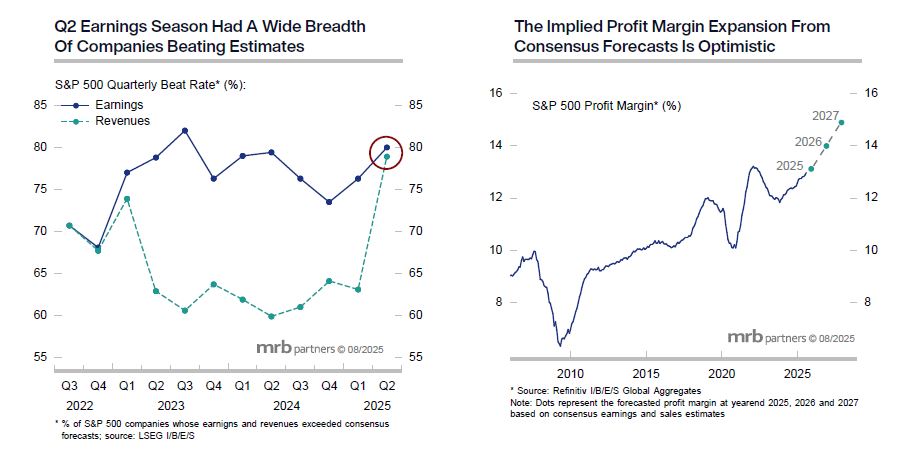

S&P 500 companies delivered better-than-expected second-quarter results that helped to assuage concerns about the economic outlook. The results also were in marked contrast with the recent pessimism regarding the employment outlook. An above-average percentage of companies beat top- and bottom-line estimates, and the corporate commentary and guidance were more optimistic than in the prior quarter.

We expect the earnings backdrop to generally remain supportive of stock prices, although it must be noted that consensus earnings forecasts for 2026 and 2027 embed very aggressive profit margin assumptions. Net: equity-bulls beware as the bar for earnings is quite high, as are aggregate valuations.