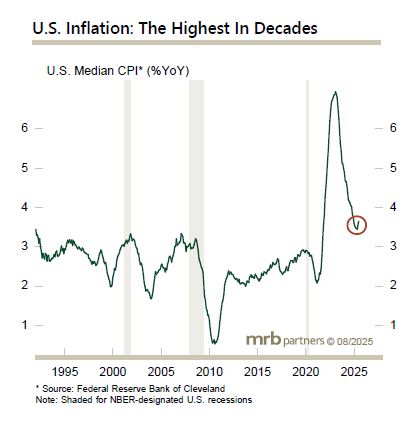

Last week’s U.S. CPI report was widely seen as benign and consistent with imminent Fed easing, which helped to sustain gains in risk asset markets. This spin ignored the fact that the report again confirmed that underlying inflation has flattened off well above the levels of recent decades as well as the Fed’s 2% target and, in fact, may even be edging higher.

While there always quirks in the components of the monthly inflation data and many different ways of trying to ascertain the underlying trend, the median U.S. inflation rate has not only troughed near 3.5% but has been edging higher. The level, as well as the recent firming, are not “benign”.

While the Treasury market may stay calm for a while longer, investors should continue to bet against a return of inflation to the low levels of recent decades.