A just-published report examined the prospects for the U.S. labor market in view of the sharp deceleration in payroll growth this spring.

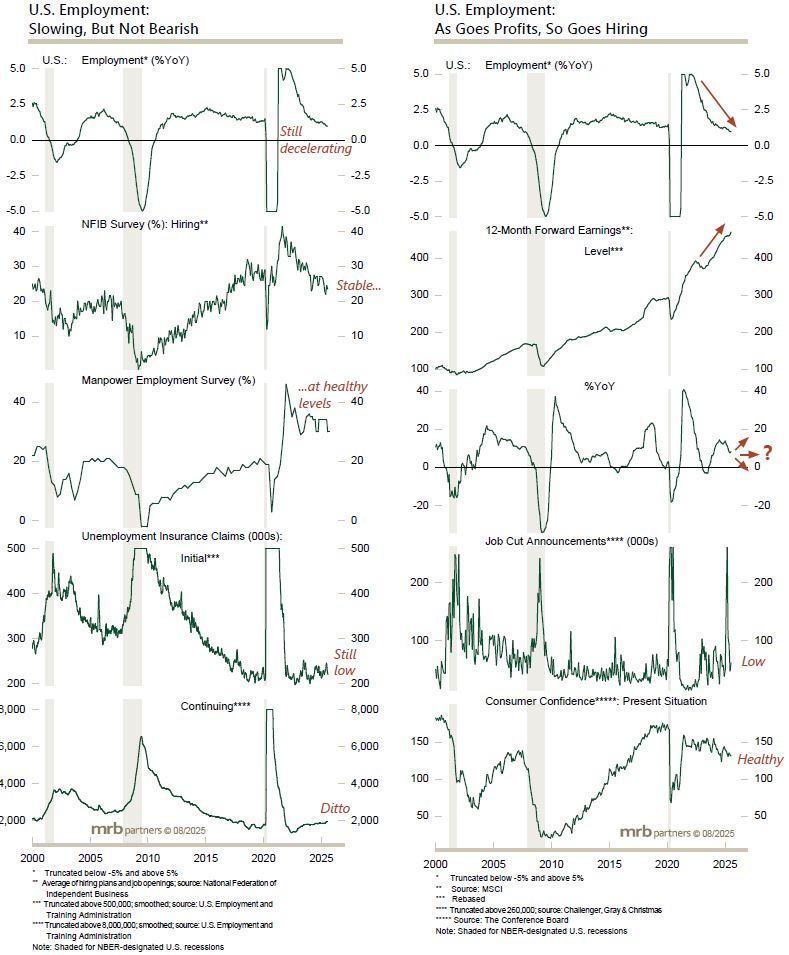

Our research highlighted that weaker employment gains since May were a symptom of the spike in trade policy uncertainty (which has since ebbed somewhat) as well as a U-turn in immigration, rather than active layoffs. A broad range of labor market data, such as initial unemployment claims and layoff announcements, indicate that conditions remain generally stable even if softer of late.

The U.S. business sector has shifted into a “low-hire, low-fire” mindset. Elevated profits are sustaining payrolls (so no firing), but heightened uncertainty over government policies and much higher tariff rates, have caused many executives to put risk-taking on hold (low hiring).

We remain of the view that while U.S. growth will be mushy this year as the economy navigates the trade war, growth will return to above-potential next year on the back of a positive fiscal policy impulse, looser monetary policy, and a sequentially smaller hit from trade policy. We anticipate that U.S. corporate profitability and cash flow generation will remain historically high and, thus, employment growth will ultimately stay positive.