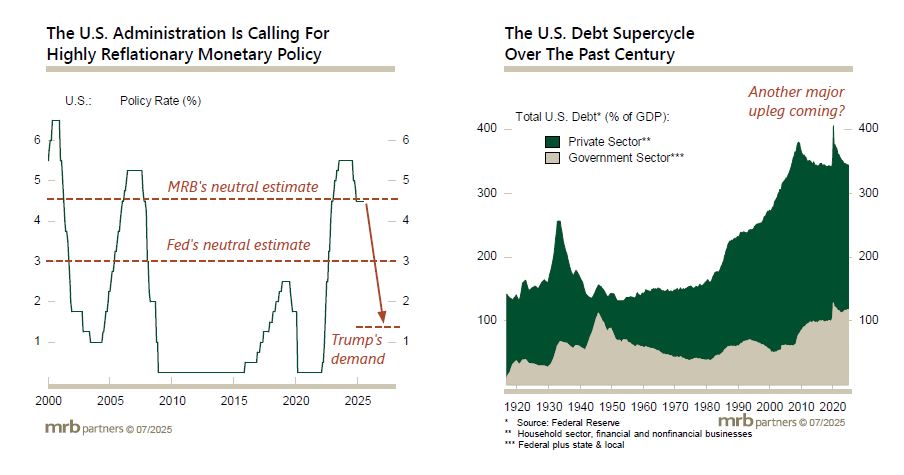

A just-published report examined the growing prospects that the U.S. Federal Reserve will lose its independence and be forced by the administration to slash its policy rate, regardless of economic conditions and the inflation outlook.

Removing the Fed’s independence and slashing policy rates would drive short-term interest rates lower but would risk a bond market riot. Policymakers likely would need to use unorthodox policies, such as an “operation twist”, to contain long-term Treasury yields, i.e. by only issuing short-term paper and possibly buying long-term Treasurys. Such a backdrop would lead to a dangerous extension of the Debt Supercycle, albeit only for as long as bond yields do not surge and derail the economic expansion.

The result of such an unprecedented change in the monetary landscape would be significant global monetary reflation and related asset price inflation. Our advice under such an outcome would be to enjoy it while it lasts, but to keep a close eye on the exit as the fallout of such extreme policies would be financial and economically painful. Stay tuned.