A just-published report updated our global investment recommendations and strategy. After a string of political “wins” and the rekindling of animal spirits in financial markets, it was not surprising that President Trump would return to the tariff war. In contrast with earlier this year, however, investors are mostly ignoring the rhetoric, as Trump has provided plenty of wiggle room for countries to negotiate a deal.

We anticipate that the U.S. will ultimately walk back aggressive tariffs and pursue individual deals, rather than risk economic weakness and a financial market crisis. Despite this anticipated endpoint, the negotiating style implies that there could be periods of high volatility. This is a challenging environment for portfolio positioning and requires investors to remain tactical.

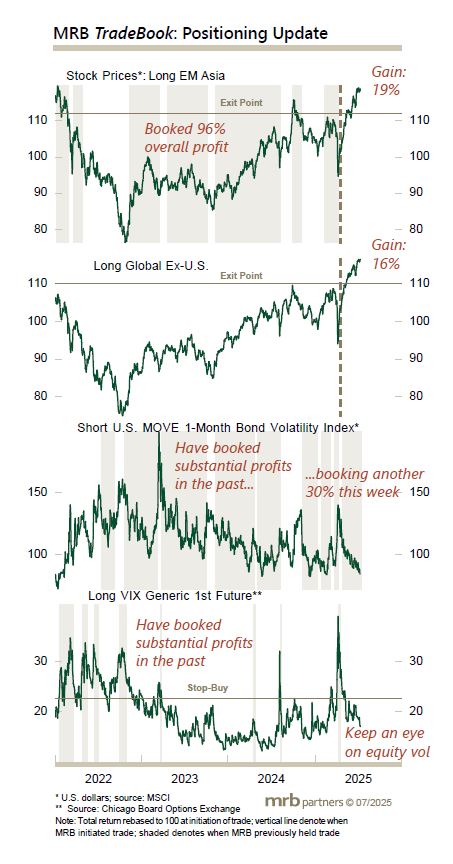

The MRB TradeBook currently has a pro-growth tilt, but we are keeping tight stops on long equity positions to protect against possible policy missteps. Moreover, we have successfully traded some of the wild swings in bond and equity market volatility, booking a 30% gain in the bond MOVE index last week. We also have a long VIX Index Generic 1st Futures recommendation in the MRB Watchlist as a hedge against another policy-induced risk-off episode.