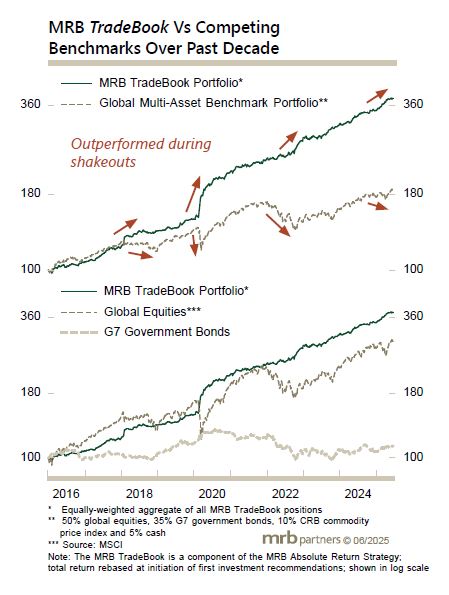

A just-published report updated the performance of our MRB TradeBook over the first half of the year, highlighting that once again the portfolio outperformed the global multi-asset benchmark portfolio with much lower volatility.

Global financial markets have experienced major swings so far this year, due to extreme policy shifts. One big theme this year, which was kicked off with a short but sharp bout of risk-off, has been U.S. tariff policy, which spurred global investors to pull back from U.S. equities and the U.S. dollar. This generated a number of winning trades for MRB, as we had positioned for outperformance by select non-U.S. equities and currencies.

There are several other budding themes developing, such as the potential for a further meaningful bear steepening in developed market (DM) yield curves. This theme will be driven by resilient global growth, sticky DM inflation and a continued deterioration in government finances, from a starting point of already massive budget deficits and debt levels.