A just-published report updated our view on Fed policy following the latest FOMC meeting. The policy rate was left unchanged, but the DOT plot shows that two rate cuts are anticipated by year-end.

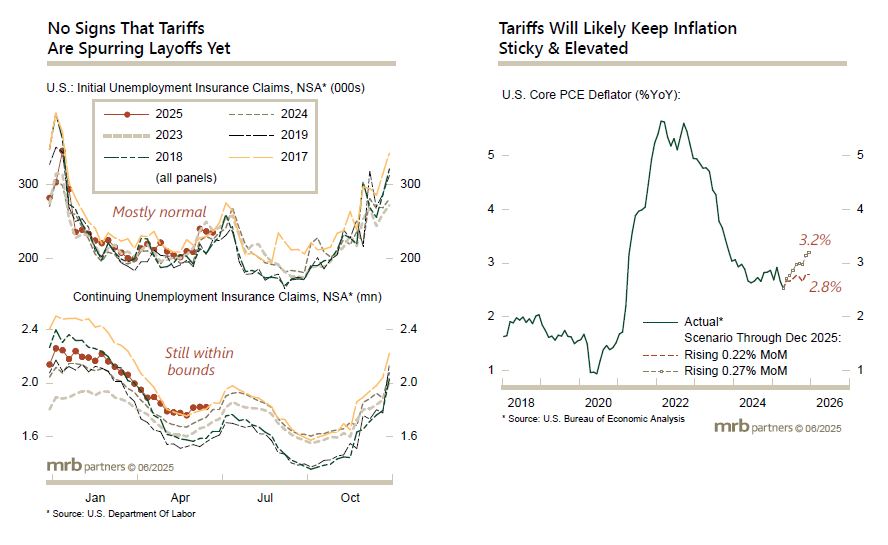

The FOMC has a dovish bias and has been looking for an opportunity to cut rates further. The economy and, more recently, the tariff war have not provided the Fed with the latitude to ease. Moreover, the Fed is now forecasting somewhat higher inflation next year than it had previously. Moreover, the forecast envisions inflation holding above the Fed’s 2% target in 2026.

While the Fed may yet ease before year-end, rate cuts are not economically warranted and we anticipate yet another unwinding of rate cut expectations in 2026. This, in turn, will coincide with higher Treasury yields.