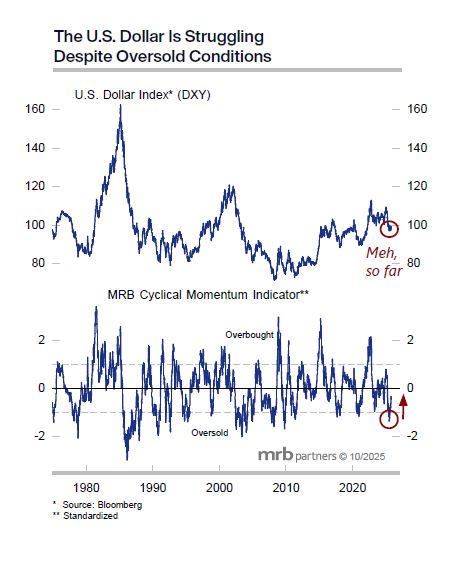

The U.S. dollar has recently confounded both bulls and bears. After nose-diving in the opening months of 2025, the dollar has mostly tracked sideways since mid-year. We see this stability as just a pause in an ongoing cyclical downtrend.

Further Fed rate cuts, a stand-pat ECB and additional (albeit glacial) BoJ rate hikes, plus a higher probability of positive economic surprises outside of the U.S., all will weigh on the dollar going forward. While investor/speculative positioning and momentum indicators by mid-year pointed to high odds of a rebound in the dollar, so far rallies have been both anemic and brief.

When an asset fails to advance much after extremely oversold conditions develop, it typically warns that the primary trend is down.